The The Second Revolution But this time It’s all about digital started In the decade 80sAs we approach Website and allowed connection between computers. This link provided inspiration Digitization From various industries, not just entertainment, to banking, manufacturing, healthcare. The pandemic we experienced a few years ago accelerated the adoption of disruptive technologies by companies and workers as they adapted to the new stay-at-home order.

Although there is no clear consensus on the definition of digital economy, Generally, reference is made to everyone Economic activities that depend on or benefit from digital resources such as information and communication technologies (DIC), Digital infrastructure, Digital products, services and data. Measuring the reach of the digital economy and its contribution to overall economic growth is challenging because digital resources are integrated throughout the global value chain.

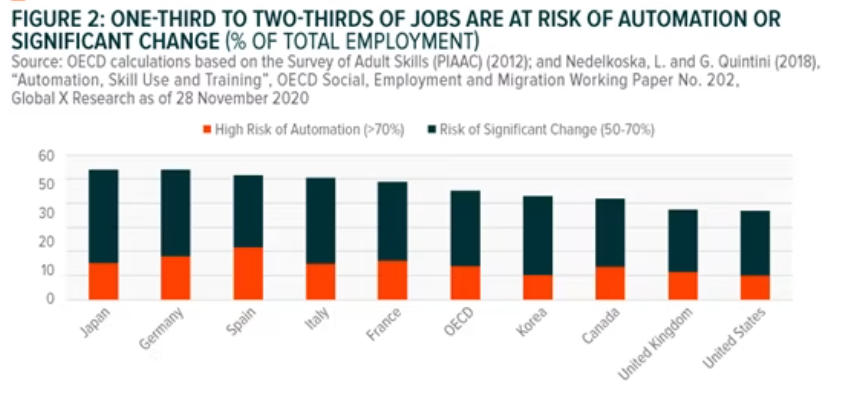

Generally, Between 2006 and 2017 the digital economy is estimated to have accounted for half of value added and close to half of new jobs in G20 economies. According to OECD data. In In developing countries, its importance is less, Represents roughly a quarter of total employment. Digital transformation is expected to increase long-term productivity, reduce costs, increase demand for innovative new products, and ultimately create employment in digital sectors. In contrast, sectors with a low digital presence are expected to experience job losses due to automation.

Digital transformation of business models

Digital innovations are changing the entire ecosystem. They arise New business models across all services, from entertainment to finance, subscription models (e.g. Netflix), free models (e.g. Instagram, Facebook, etc.), on-demand models (e.g. Uber) or sharing models (e.g. AirBnB), to name a few. Mention. Similarly, technology companies are changing the traditional manufacturing business model by integrating data analytics into hardware, which has led to the emergence of IoT (Internet of Things) business models, such as predictive maintenance and models. In a results-based business, you sell and price. In terms of performance rather than hardware9. The hardware-centric business model in manufacturing is moving toward a broader business model that includes hardware, software, and services, blurring the lines between traditional sectors.

But dominance is sought in this digital race

Adoption of digital technologies is heterogeneous across industries and countries, which has created growing disparities in terms of digital infrastructures, skills, regulations, and societal preferences, resulting in the fragmentation of the digital economy. Most tech companies are located in America and Asia, while Europe captures only 10% of global funding for its startups.

Technology has become a growing source of geopolitical tensions within the West and between the United States and China in recent years. In response, international cooperation in digital technology is emerging among Western countries. Joe Biden’s victory in the US presidential election revived talks between the US and the EU around the transatlantic agenda, which includes policy proposals in the digital environment, including common approaches to antitrust enforcement and cyber security. The agenda underscores the commitment of the EU and the US to shape the digital regulatory environment.

Disruption is a central theme in digitalization in portfolio construction

The disruptive nature of the digital economy challenges traditional investment structures. Conventional portfolio construction is built around managing traditional sector allocations relative to a benchmark to generate excess return or minimize risk. However, traditional sectors are already heavily skewed towards well-established segments of the economy and historically successful companies. On the other hand, companies leading disruptive topics, such as implementing the Internet of Things (IoT) to improve the manufacturing process, are typically smaller in size and span different sectors and geographies. Accurately capturing these companies requires a future-oriented investment approach that goes beyond traditional sector structures to identify the fastest growing trends over the next decade.

The Thematic investing is an investment approach that involves in-depth research to identify Los Disruptive tendencies This will drive value creation in the future, as well as companies that are better positioned to benefit from the materialization of these trends.

Los Thematic ETFs and mutual funds can help investors gain targeted exposure to these disruptive trends in a single investment.. They use a systematic investment process to assemble baskets of securities that provide unique and diversified exposure to disruptive trends.

To precisely target these disruptions, thematic ETFs should only include specialty companies that stand to gain the most from exposure to these trends. Thematic investing is therefore a growth-oriented strategy that not only has the potential to outperform over the long term, but also creates unique building blocks for preparing global equity portfolios for an increasingly digitized world.

You are interested

If you want to learn how to invest and manage your assets, Investment Strategies has created an online course so you can learn how to invest for the short, medium and long term with us. Online course to learn how to invest in stock market and mutual funds With a commitment of 15 minutes a day, you will learn to apply fundamental analysis, technical analysis, macroeconomic analysis or operations with mutual funds and ETFs to your investors.

Any investor can be trained in one of our global investment courses. More info here