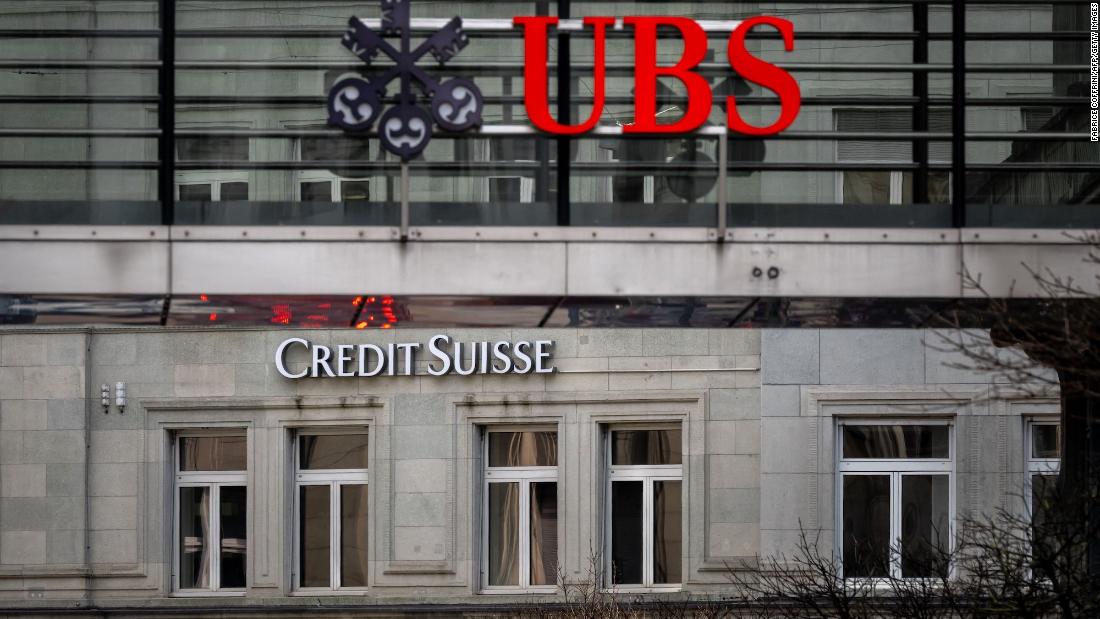

London (CNN) UBS, Switzerland’s largest bank, agreed to buy it Ailing rival Credit Suisse The emergency bailout deal was aimed at stemming the financial market panic unleashed by the failure of two US banks earlier this month.

“UPS today announced the acquisition of Credit Suisse,” the Swiss National Bank said in a statement. “The acquisition was made possible with the support of the Swiss federal government, the Swiss Financial Market Supervisory Authority and the Swiss National Bank,” the central bank added.

It said the rescue would “protect financial stability and the Swiss economy”.

UBS is paying 3 billion Swiss francs ($3.25 billion) for Credit Suisse, about 60% less than the bank was valued at when markets closed on Friday. Credit Suisse shareholders will be largely wiped out, receiving just 1 UBS share for every 22.5 Credit Suisse shares they hold. Unusually, after the Swiss government agreed to change the law, shareholder approval was not required for the deal to be completed quickly.

Swiss debt (CS) Losing the trust of investors and customers over the years. In 2022, it posted its worst loss since the global financial crisis. But confidence plummeted last week after it admitted to “material weakness” in its accounting and the demise of Silicon Valley Bank and Signature Bank fueled fears of weaker institutions at a time when rising interest rates undermine the value of some financial assets.

Shares of the 167-year-old bank fell 25% in the week as money poured out of the investment funds it manages and at one point account holders were withdrawing more than $10 billion in deposits a day, the Financial Times reported. The Swiss National Bank’s emergency loan failed to stem the bleeding.

In desperation to prevent a spillover into the global financial system on Monday, Swiss authorities pushed hard for a private-sector bailout, with less government backing, and are said to be considering Plan B — full or partial nationalization.

The emergency takeover was agreed after a day of frantic negotiations involving financial regulators in Switzerland, the United States and the United Kingdom. UPS (UPS) And Credit Suisse ranks among the 30 most important banks in the global financial system, with assets of nearly $1.7 trillion.

“In the recent unusual and unprecedented circumstances, the announced merger represents the best available decision,” Credit Suisse Chairman Axel Lehman said in a statement.

“This is a very challenging time for Credit Suisse, and while the team has worked tirelessly to resolve a number of significant legacy issues and implement its new strategy, we are compelled today to reach a solution that delivers a lasting result.”

The global headquarters of UBS and Credit Suisse are just 300 yards away in Zurich, but the banks’ fortunes have recently taken a different path. Shares of UBS have risen 15% over the past two years, and are forecast to generate $7.6 billion in profits by 2022. According to Refinitiv, the stock had a market capitalization of $65 billion on Friday.

Credit Suisse shares have lost 84% of their value over the same period, and last year it posted a loss of $7.9 billion. It was worth just $8 billion at the end of last week.

Since 1856, Credit Suisse has its roots in the Schweizerische Kreditenstalt (SKA), which was set up to finance the expansion and industrialization of Switzerland’s railway network.

As well as being Switzerland’s second largest bank, it oversees the wealth of many of the world’s richest people and provides global investment banking services. It will have more than 50,000 employees by the end of 2022, 17,000 of them in Switzerland.

The Swiss National Bank said it would lend 100 billion Swiss francs ($108 billion) to UBS and Credit Suisse to boost liquidity.