While the near-term data looks relatively positive, we believe a recession is a very real possibility for the US and European economies in the coming months. Bad news for investors? While any recession is challenging in the short term, it can be a necessary way to contain inflation and provide new entry points for investors.

An imminent recession, a precursor, would not be good news. A recession, by its official definition (two or more quarters of negative growth), can hurt companies, increase unemployment, and negatively impact financial markets. However, we believe that a recession is inevitable and necessary for major economies to recover from the effects of Covid-19 and the war in Ukraine. What’s cool new?

Recessions can also provide potential entry points for investors as stock market valuations correct and economies begin to recover.

Should investors prepare for a soft landing or a bumpy ride?

Our base case: We expect a recession in the US and Europe by the end of this year or early next.

In the short term, the economic data is relatively positive. Although US, Eurozone, UK and Chinese purchasing managers’ indices are weakening, they do not yet signal an imminent slowdown. On the other hand, inflation for the top three is declining faster than expected. Taking all these factors into account, investors may think that major economies can avoid recession. This explains, at least in part, the strength of stock markets and the relative stability of fixed income yields. Recent market moves have undermined some of the rally in stocks and pushed long-term U.S. government bond yields to multi-year highs.

So, we believe the warning is justified. Indeed, the global economy navigates a delicate balance between strength in the short term and increasing weakness in the medium term.

Price pressures may have eased, but annual core inflation remains well above the central banks’ 2% target. In addition, inflation may stabilize higher due to the impact of the war in Ukraine and the El Nino weather pattern, among other factors, on food and energy supplies. However, central banks expect to see strong evidence of a slowdown in price inflation before cutting interest rates again. For their part, money markets are dismissing the possibility of the US Federal Reserve (Fed) raising rates from the current 5.25% to 5.50%, before cutting them to 4% over the next two years.

In our view, this scenario is possible, but we believe that in 2024, before a recession hits, markets may begin to price in lower price cuts. Therefore, policymakers hope that by holding rates longer, they can achieve a soft landing in which inflation returns to a sustainable target and the economy emerges relatively unscathed.

But in practice, it can be very complicated. Remember that history offers little comfort: Whenever central banks have raised interest rates sharply to fight inflation, the result has always been a recession.

It is useful to think of recessions as an escape route that reduces the risk of economies overheating. And more importantly for investors, it could create the perfect conditions for a rally in riskier assets.

Should investors fear a recession?

Several leading indicators match our recession forecast. More importantly, yield curves are inverted. This is unusual and short-term bonds outperform long-term bonds with the same credit risk profile. In other words, investors expect long-term interest rates to fall because economic conditions worsen. An inversion of the U.S. government bond yield curve has typically been an indicator of a recession in the world’s largest economy (see Figure 1), although the exact timing of a recession varies.

Chart 1: Recessions in the US are generally anticipated by an inversion of the US yield curve

But what is the most likely type of recession? It is still too early to judge based on the data the duration and extent of a potential recession.

However, there are several factors that explain why a recession is more likely than a soft landing or no landing, where the economy continues to show some resilience. The prospect of interest rates remaining high for a longer period, thus slowing economic growth, has been reinforced by recent strong US retail data and signs of continuing wage pressures. Additionally, Moody’s credit ratings of several mid-sized U.S. banks may rebound after challenges faced by the industry in early 2023. There is another factor to consider: the real estate market is sluggish as it enters a period of rising prices. . If house prices fall faster than expected, the recession will be more severe than the markets expect.

How should investors react in a recession?

During a recession, investors should consider the following aspects:

- Be patient: Recessions require patience from investors. You should also consider how to manage risk when the economic cycle begins to change. In the medium term, recession poses challenges for companies as economic growth slows and then contracts. This scenario is generally negative for equities, but strong companies can sustain it.

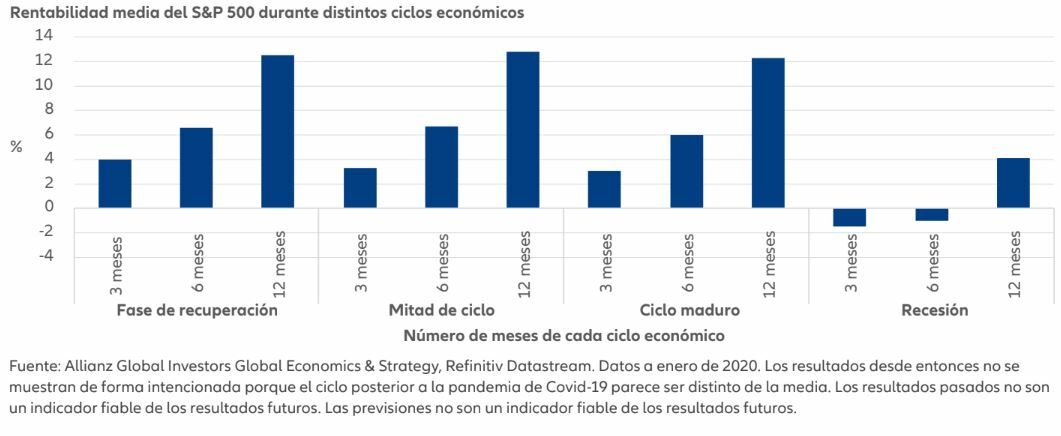

- Keep an eye on profits: Recessions present opportunities to buy during sales season. Earnings expectations often fall during recessions. That point could provide investors with a potential entry point, as stock prices “climb the wall of anxiety” even when the market faces negativity. After an initial downturn, riskier assets such as stocks begin to perform better during (and before) recessions as investors begin to focus on expectations of a future recovery in the economy (see Chart 2).

- Note the rebalancing: For now, some valuations of US stocks, based on the cyclically adjusted Shiller price/earnings (PER) ratio, may be historically high. In the event of a recession, valuations may reset and buying opportunities will arise.

- Watching Rates: As the Fed nears the end of its current rate hike cycle, we see the potential for extended term risk in the US government bond markets, meaning portfolio interest rate sensitivity.

Chart 2: Stocks typically begin to recover late in a recession

With a recession on the horizon, it’s time to be nimble and versatile, looking for opportunities beyond the economic challenges.

You are interested

If you want to learn how to invest and manage your wealth, Investment Strategies has created an online course so you can learn how to invest for the short, medium and long term with us. Online course to learn how to invest in stock market and mutual funds With a commitment of 15 minutes a day, you will learn both fundamental analysis, technical analysis, macroeconomics or working with mutual funds and ETFs.

Any investor can be trained in one of our global investment courses. More info here