Inexplicable remarks to Minister of Economy and Finance Jose Arista and Minister of Energy and Mines Romulo Mucho.

1.- As a result of the PetroPerú privatization question in 1996, the majority shares of the country's most important La Pampilla refinery were privatized for $180.5 million, including US$38 million in depreciated debt securities. Outside of Peru. The La Pampilla refinery was bought by Spanish multinational Repsol and will have the largest participation in the fuel market from 1997 to 2023, particularly in the country's main market, the capital city of Lima.

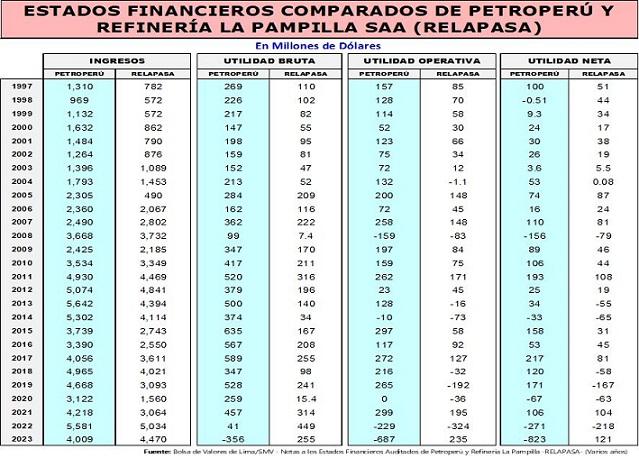

2.- As can be seen in the table, within four years (1997/2000) the Spanish transnational recovered the value paid by the La Pampilla refinery, due to the clear undervaluation of the assets, the market situation and the insured customers.

3.- As can be seen in the table, in most years PetroPeru has higher income, gross profit, operating profit and net profit in relation to the competition of the La Pampilla SA Refinery (Relapasa). In fact, the profits of the state oil company are large, they capitalize the country, while Relabasa's surpluses are transferred to its shareholders in the parent company.

4- In the years 2018, 2019, 2020, despite being years of economic growth, except for 2020, when both companies “announce operating and net losses as a result of the contraction of the economy by the Corona virus. “Crisis.

5.- Since 2015, PetroPerú has made the most important investment in its history with the construction of the new Talara refinery, spending more than 6.5 billion dollars, during which period it achieved higher operational and net profit than the competition. Excluding 2020, a third of its revenue has fallen due to the economic slowdown that has hit the fuel market.

6.- Throughout its history PetroPerú has been self-sufficient, generating resources for the public treasury outside of tax collection through fuel sales. All this even after the privatization that started in the 90s of the last century, the Dalara, Zocalo Continental and Lot 8 (Trompeteros) oil lots, as well as pipelines such as Solgaz, Transocina, and profitable subsidiaries were privatized. Dept.

7.- As a result of the closure of the Talara refinery due to the construction of a new refinery, no fuel was processed from 2020 to 2023, and PetroPeru had to import fuel to supply the domestic market fuel sales in the Amazon.

8.- Since 1997, for the first time in history, Relapasa exceeds revenues in 2023 with positive operating and net profit, while PetroPeru announces gross, operating and net losses due to liquidity crisis, negative working capital, loss of share in fuel. Market, lack of governance, political interference by ruling governments, case of Pedro Castillo.

9.- As a result of this crisis, since 2022 PetroPerú has had to seek the capital contribution of its main partner, the Peruvian State, and to obtain more credit support in the face of a crisis of credibility against private banks.

10.- The New Talara Refinery with its maximum capacity of 95 thousand barrels per day, 16 new modern industrial processes and its own oil and gas production, according to prestigious international consultations, the profitability of PetroPeru is guaranteed.

11.- This information is for the information of Ministers of State Jose Arista and Romulo Mucho, who are not familiar with the hydrocarbon sector, but are key members of the Board of Shareholders of PetroPeru, a very important company by law. Peruvian state.