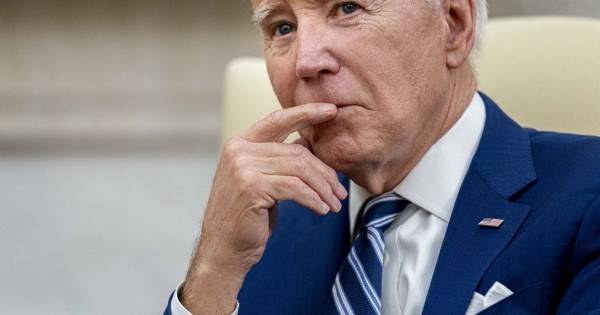

Recent economic data indicate that the US is enjoying a strong labor market, steady economic growth and cooling inflation following a brief recession caused by the COVID-19 pandemic. However, according to survey data, perceptions of the economy have not improved and many households report general dissatisfaction with the state of the economy. What accounts for this disconnect between economic status and American sentiment? The Brookings Institute hosted a webinar LPO joined in and tried to unravel the mystery. But, as in other cases, it remains a mystery why the Biden administration can't use it objectively to its advantage in polls and election numbers.

For Ben Harris, a vice president and director of Brookings and a former Treasury adviser until April of last year, there are three plausible explanations. The first is obvious: people find the current economy unsatisfactory. “This could be due to dissatisfaction with price levels or dissatisfaction with long-term structural issues such as economic inequality and housing affordability, but the central hypothesis is that people are unhappy with the current economic landscape,” he says.

Consumption and investment: the first victims of the election uncertainty fueled by the Biden-Trump fight

A second explanation relates to what Wall Street Journal columnist Greg Ebb, who participated in the debate, calls “referred pain”: how people's dissatisfaction with non-economic issues affects their views of the current economy.

A third explanation relates to how people receive and process information. Part of this may have to do with asymmetric amplification, or the idea that Republicans amplify negative sentiment more strongly when a Democrat is in the White House. “Another aspect of this is that economic news reporting has turned systematically negative in recent years, but this mystery remains unsolved in my view,” Harris said.

For his part, along the same lines, Democratic economist Jason Furman, former director of Barack Obama's Economic Council and a Harvard professor, rehearsed his answers, but began by saying that “people should be really happy” with Biden's economy. He said that people think the economy is bad because they are comparing it to 3 or 4 years ago instead of the most recent year or period.

He also gave an example of what happened in the thanksgiving speech. “Dinner that night was cheaper than the year before. But you can see how Thanksgiving dinner has grown over the last three or four years, and it was 30% more than any increase on Thanksgiving in history.” He said he was trying to explain or understand how the public's perception of the economy and prices would be.

“Psychologically, the question is, when people are forming their view of the economy, over which time period do they measure inflation? Do they measure it over six months, if inflation is really very low? Six months out, that is, inflation is really very low? And 12 months?” Do they measure over, where it's a little higher than pre-Covid, but it's reasonably low? , 26, 38, 44 months? For a long time people have been measuring inflation, and they often have what we often call a high price level and a disappointingly high price level. will enjoy,” said Furman, who served under Barack Obama.

The Harvard economist cautioned, however, that real wages and incomes are still far from perfect for many, although they are improving rapidly. “However, I don't think all of this is economically relevant for the most part. It has nothing to do with consumer spending. So really, for me, the answer is in the political arena. Finally, it raises important political considerations.” he said. “However, my most important point is that I find this topic both infinitely fascinating and infinitely confusing,” Furman admits.

Sarah Eisen, co-host of CNBC's “Squawk on the Street” and “Money Movers,” moderated a panel that asked why things feel so good in popular indexes that measure consumer sentiment, precisely when the economy is good and jobs are good. More strongly, to understand social unrest. “Consumers are happy to be working. Some of them have seen significant wage increases, especially if they're in labor-intensive services. People are happy that prices aren't rising as quickly. And they're happy that interest rates aren't. It's so high, mortgage rates are down. But, it all costs a lot of money. , especially for basic commodities like food and energy,” explained Dana Peterson, chief economist and president of the Economic Center. , Strategy and Finance of the Conference Board (which prepares accurate measurement of consumer sentiment in the country).

Peterson agrees that price levels are high and people are noticing. “Also, in terms of utilities, housing costs and rents are still high. Whether you want to buy or get a car, you know the cost of life insurance is high. All this aside. , make consumers a little more confident, but they are also very concerned. And, “I would also add that a lot of consumers are still very upset because they can't afford the homes they want, even though mortgage rates aren't as high. Or it's no longer 8%, which is still higher than what we've seen in recent years. So I think it's a very different story,” he says.

“Consumers feel good and bad at the same time,” he adds. “But given the current state of the economy, do you wonder if they're not feeling better?” asked the CNBC host.

“Well, I think the economy is made up of different parts. So we can look at it by industries or components of GDP. Last year there were definitely some industries that had a recession. If you work in those industries, you're probably going to have a really bad time.” Perspectives on Economics. For example, industries such as technology and finance, but also manufacturing and transportation, warehousing, residential construction and even some areas of retail. So they are big businesses. And “people in those sectors saw job losses or saw their companies' profits decrease. But many industries did well, including services-focused industries,” explained The Conference Board's director.

Greg Ip is the chief economic critic for The Wall Street Journal. The journalist also rehearsed his response to the mystery that has dogged the Biden administration. “Inflation is really the elephant in the room. It doesn't solve the whole mystery, but it's part of it. But I like to believe that inflation has a deeper impact than people realize, and certainly more than economists realize.” can explain,” he noted.

“People hate inflation because it's fundamentally destabilizing. The feeling that prices are rising rapidly, not all at the same rate, but different things are rising at different rates is very confusing. It's destabilization, it reveals a lack of control. That's why inflation has been so bad for rulers in power throughout history. ” insists a star columnist for The Wall Street Journal. In fact, he says, sentiments are just as bad today when inflation was as bad in the 1970s as it is now.

“I actually asked people where they want prices to go; they don't just want low inflation, they want deflation. They want prices to go back to where they were three or four years ago,” notes Ip.

Finally, Justin Wolfers, a nonresident senior fellow in economic studies at the University of Michigan, recalled past research to explain the phenomenon.

“We're trying to track what's happening to happiness, not consumer sentiment. And there's a whole literature of looking at what drives happiness. And a hard rule of thumb is that unemployment is twice as important as a percentage point. Happiness than inflation. We've used the misery index in the older literature, and inflation. Let's add unemployment. Now the misery index isn't at an all-time low, but given twice unemployment it's coming. Given the weight more than inflation, and the average happiness of the population as a whole, the fact that unemployment is near its lowest level in 50 years is absolutely fascinating and yes, the economy is significant. is strong in terms of,” he asserted.

Wolfers says there are two empirical facts on the table: one is that the economy is strong, and the other is that people are miserable. “I think it's very difficult to tell a story that the economy is not strong.”

He ended with a story. “If you go to sleep at the end of 2019 and wake up at the beginning of 2024, you will find that GDP is actually higher than when you were sleeping. Then you will say to the nurse: Oh my goodness, what positive things do you see? Did this happen in the economy while I was sleeping? In fact, you have a global epidemic. And you will be surprised to know that the global recession has been slept on,” he noted in another attempt. is a conundrum for economists and the White House.